Digital Currency: What It Is, How It Works, and Where to Use It

When you hear digital currency, a form of money that exists only in electronic form, often built on blockchain technology. Also known as cryptocurrency, it virtual asset, it's not just about Bitcoin or Ethereum anymore—it's about how money itself is changing hands, borders, and rules. Digital currency lets you send value directly to someone else without a bank in between. That’s the core idea. But in practice, it’s messier. Some digital currencies are backed by real assets. Others are just hype with a logo. Some work on public blockchains. Others are locked inside private systems you can’t even see.

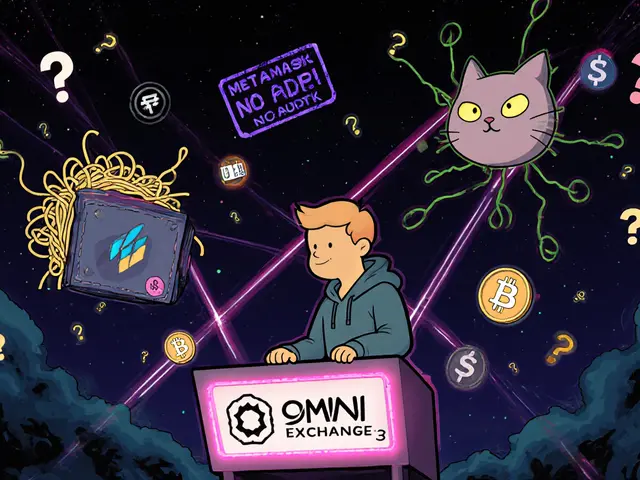

What you find in the real world? crypto exchange, a platform where you buy, sell, or trade digital currencies platforms that look legit but aren’t. Exchanges like COREDAX in Korea or KCCSwap on KuCoin’s chain have real rules, local support, and bank links—but only if you’re in the right country. Meanwhile, fake ones like CreekEx or Woof Finance are designed to vanish with your money. And then there’s DeFi, a system of financial tools built on blockchains that let you lend, borrow, or trade without middlemen—like Ref Finance on NEAR, where you swap tokens for less than a penny in fees. But DeFi isn’t magic. Flowmatic ($FM) collapsed because no one used it. Project Quantum (QBIT) has no game, no team, and no liquidity. DeFi works only when real people are trading, not just waiting for an airdrop.

Digital currency isn’t just about trading. It’s about regulation. Vietnam lets you trade crypto but bans stablecoins. Nigeria lifted its ban but enforcement is patchy. The UK’s HM Treasury now requires exchanges to follow FCA rules. And in Venezuela, the government forces miners into state pools. Where you live changes what digital currency means to you. Some people use it to avoid taxes by moving abroad. Others chase airdrops like BUNI or DSG tokens—only to find out the tokens have zero trading volume. Even NFTs, which prove ownership on a blockchain, are part of this world. They’re not just art. They’re digital receipts for something that may or may not exist.

You’ll find all of this in the posts below: real reviews of exchanges that work, deep dives into tokens that failed, and clear breakdowns of airdrops that were scams or swaps in disguise. No fluff. No guesswork. Just what’s actually happening with digital currency right now—and how to stay safe while navigating it.