Koinex Shutdown: What Happened and How It Changed Indian Crypto

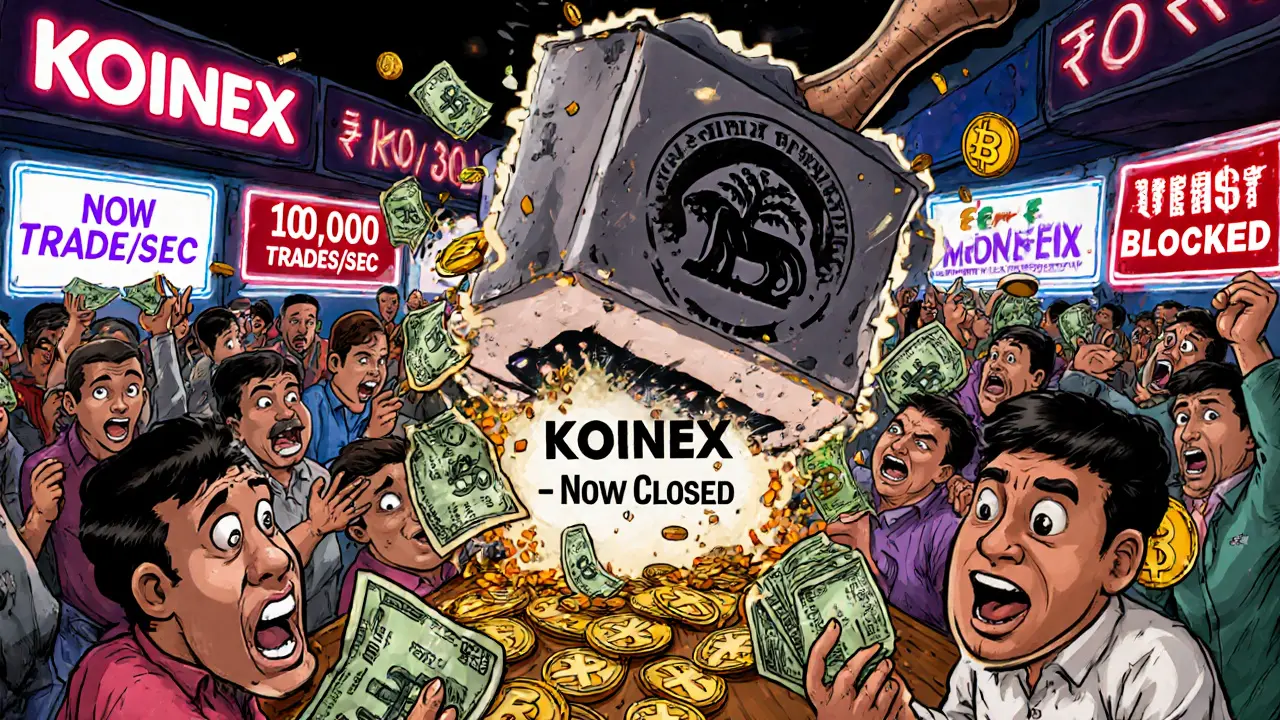

When Koinex, India’s first major cryptocurrency exchange that let users trade Bitcoin, Ethereum, and dozens of altcoins directly with INR. Also known as India’s first crypto trading platform, it was the go-to place for thousands of Indian crypto buyers before it vanished overnight in 2019. Koinex didn’t just shut down—it left behind confusion, lost funds, and a wake-up call for an entire market. At its peak, it handled over $10 million in daily trades, had a simple interface, and supported local bank deposits. But then, without warning or explanation, the website went dark. Users couldn’t log in. Customer support stopped replying. And the company’s founders disappeared. No official statement. No refund plan. Just silence.

This wasn’t just a technical failure. It was a regulatory storm hitting a market that wasn’t ready. The Reserve Bank of India, India’s central bank that banned banks from serving crypto businesses in 2018, creating a banking blackout. Also known as RBI, it had already forced Koinex to cut off INR deposits months earlier. Without access to banks, Koinex couldn’t process withdrawals. The Supreme Court of India, the highest court that overturned the RBI’s crypto banking ban in 2020, restoring legal clarity. Also known as Indian Supreme Court, it hadn’t ruled yet. So Koinex was stuck between a banking freeze and growing user pressure. Many users lost thousands of dollars. Others held onto their coins, hoping for a recovery that never came. The shutdown didn’t kill crypto in India—it just exposed how fragile the ecosystem was without legal protection.

Today, the Koinex shutdown is still one of the most talked-about events in Indian crypto history. It taught traders to never keep all their funds on an exchange, to watch for banking red flags, and to demand transparency. It also pushed platforms like WazirX and CoinDCX to build stronger compliance, KYC systems, and withdrawal protections. The same regulators that crushed Koinex now license exchanges. The same users who lost money now trade legally on platforms that follow RBI guidelines. But the memory of Koinex lingers—because if it could happen to the biggest exchange in India, it could happen to anyone.

What follows is a collection of real stories, reviews, and investigations into crypto exchanges in India and beyond—some alive, some gone, some hiding in plain sight. You’ll find posts about banned platforms, regulated exchanges, token swaps that turned into scams, and how traders are still navigating the same risks Koinex exposed years ago. This isn’t just history. It’s a survival guide.