Low Liquidity Crypto: Risks, Red Flags, and Real Examples

When you see a crypto coin priced at $0.0001, it might seem like a bargain—until you realize no one’s buying it. Low liquidity crypto, a cryptocurrency with so little trading activity that buying or selling it becomes difficult or impossible. Also known as low volume crypto, it’s not just illiquid—it’s often a trap. You can’t sell it when you want to. You can’t get fair pricing. And more often than not, the project behind it has already vanished.

Low liquidity isn’t just a technical issue—it’s a survival risk. Look at Flowmatic ($FM), a Solana-based DeFi token that promised better trading tools but collapsed due to zero liquidity and abandoned development. Or TajCoin (TAJ), a coin with no real community, no exchange listings, and conflicting data across platforms. These aren’t outliers. They’re textbook examples of what happens when a token has no buyers, no sellers, and no reason to exist. The same goes for Project Quantum (QBIT), a gaming token tied to an unlaunched game with zero trading volume and no playable product. Without liquidity, even a promising idea becomes worthless.

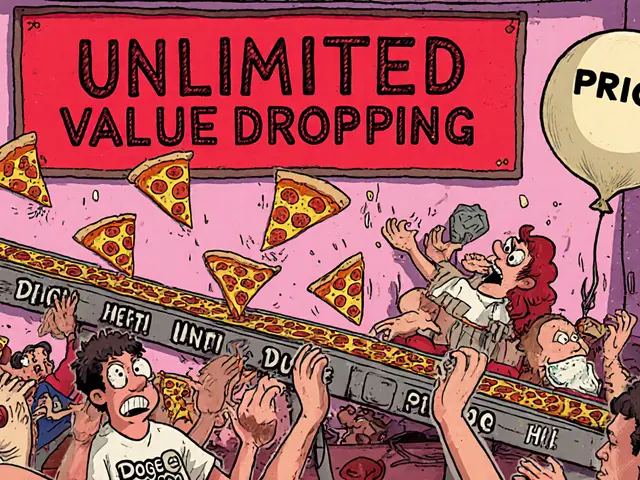

What makes low liquidity crypto dangerous isn’t just the price—it’s the silence. No trading volume means no market pressure. No one’s checking the price because no one cares. That’s when scammers step in: they pump the price with fake volume, lure in new buyers, then vanish. You’re left holding a token that can’t be sold. Platforms like SushiSwap on Arbitrum Nova, a decentralized exchange with ultra-low fees but almost no liquidity or trading activity show how even well-known protocols can become useless when liquidity dries up. This isn’t about risk—it’s about reality. If you can’t find a single buyer on a major exchange, you’re not investing. You’re gambling on a ghost.

What you’ll find below are real cases—tokens that looked like opportunities but turned into dead ends. You’ll see how fake airdrops, abandoned projects, and scam exchanges all share one thing: zero liquidity. These aren’t theoretical warnings. These are post-mortems. And they’re here to help you spot the next one before you lose money.