Solo Mining vs Pool Mining: Which Is Right for You in 2025?

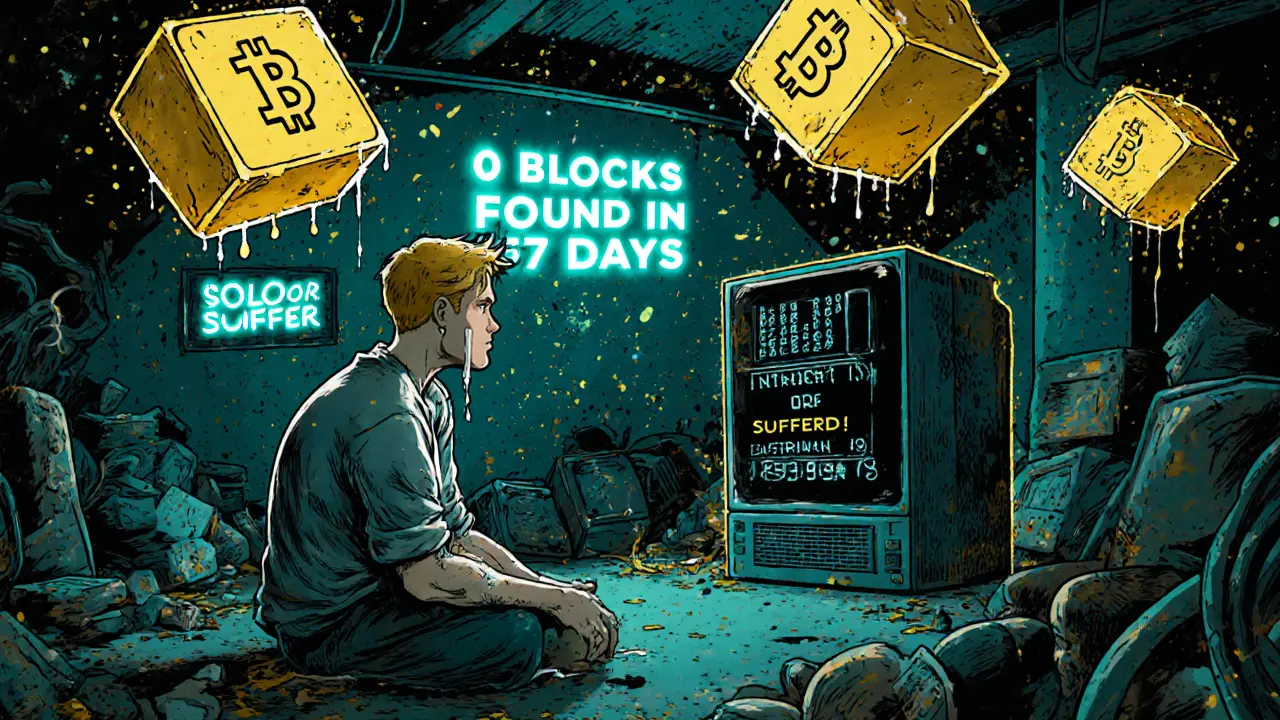

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.

When you hear mining pools, groups of cryptocurrency miners who combine their computing power to increase their chances of earning block rewards. Also known as mining collectives, they’re the reason most people get paid for mining Bitcoin and other proof-of-work coins today. Without them, solo miners with home rigs would wait years—maybe decades—to find a single block. Mining pools fix that by pooling resources, splitting rewards, and paying out regularly. It’s not glamorous, but it’s how real money gets made in crypto mining.

Think of it like a lottery syndicate. Instead of one person buying all the tickets, ten people chip in. If they win, everyone gets a share. That’s what happens in a Bitcoin mining, the process of validating transactions and securing the Bitcoin network using specialized hardware and solving complex mathematical puzzles. Also known as proof of work mining, it’s the backbone of Bitcoin’s security.. The bigger the pool, the more often it finds blocks—and the more frequent your payouts. But not all pools are equal. Some charge higher fees. Others have better payout systems. And some are so big they risk centralizing power, which goes against crypto’s original spirit.

Most mining pools work with mining hardware, specialized machines like ASICs designed to perform the intense calculations needed for proof-of-work block validation. Also known as ASIC miners, they’re expensive, loud, and use a lot of electricity—but they’re the only way to mine Bitcoin profitably at scale.. You don’t need one to join a pool, but if you’re serious, you’ll need at least one. Pools like F2Pool, Antpool, and Foundry USA handle millions of terahashes per second. They’re not for hobbyists. They’re for people treating mining like a business. And that’s exactly what you should do if you’re in it to make money.

But here’s the catch: mining pools only matter for coins that still use proof of work. Ethereum ditched it in 2022. Many newer chains never used it. If you’re looking at a coin that’s already proof-of-stake, mining pools are irrelevant. You’re better off staking. But for Bitcoin, Litecoin, and a few others still stuck in the old model, pools are the only way to earn consistent returns. That’s why the posts below focus on real-world mining setups, pool comparisons, and the hidden risks—like sudden fee hikes or pool shutdowns—that can wipe out your earnings overnight.

You’ll find reviews of actual mining pools, breakdowns of payout methods (PPS, PPLNS, SOLO), and warnings about shady operators hiding behind fake names. You’ll also see how regulations in places like Venezuela force miners into state-run pools—and why that’s a trap. This isn’t theory. These are real stories from people who lost money because they didn’t know what to look for.

9 October

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.