Solo Mining vs Pool Mining: Which Is Right for You in 2025?

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.

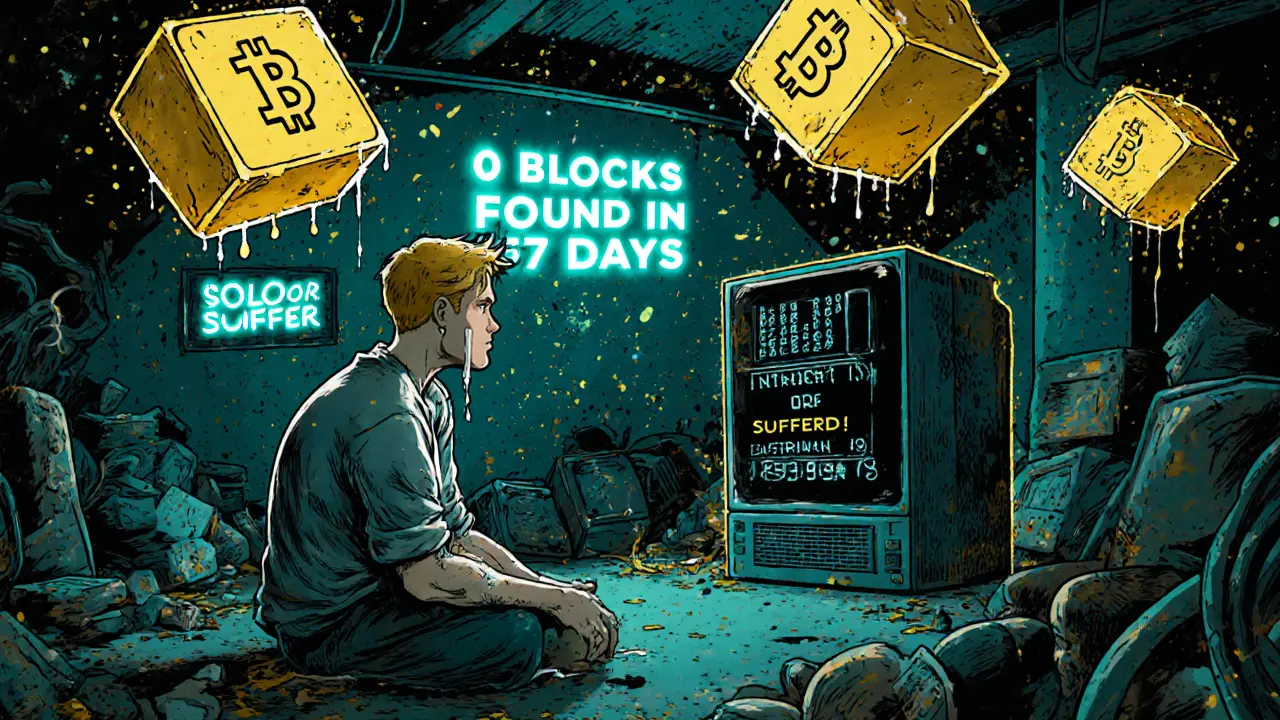

When you hear pool mining, a system where multiple miners combine their computing power to solve blockchain puzzles and share rewards. Also known as mining pool, it's the reason most people can earn crypto from mining without owning a warehouse full of hardware. Solo mining used to be common, but today, the odds of finding a block alone are so low that it's practically impossible for regular users. Pool mining fixes that by letting you team up with others — your hash rate adds to the group’s total, and when the pool finds a block, everyone gets paid based on how much work they contributed.

Think of it like a lottery syndicate. Instead of buying one ticket and hoping to win, you buy ten tickets with nine friends. You don’t win the whole jackpot, but you win more often. That’s exactly what happens in a mining pool, a group of cryptocurrency miners who coordinate their efforts to increase their chances of earning block rewards. The bigger the pool, the more consistent your payouts — but you also pay a small fee to the pool operator. Some pools pay out daily, others only after hitting a minimum threshold. You’ll also see terms like hash rate, the speed at which a miner performs calculations to validate transactions on a blockchain — this determines how much you earn. Higher hash rate means more shares, more rewards.

But pool mining isn’t just about profit. It’s about survival in today’s crypto landscape. As block rewards shrink and difficulty rises, only those who join pools stay in the game. Countries like Venezuela even force miners into state-run pools, showing how central this model has become. Meanwhile, many crypto exchanges and DeFi platforms now offer cloud mining contracts tied to pools — but most of them are scams. The real ones? They’re transparent about fees, payout schedules, and hashrate tracking. You can see exactly how much you’re contributing and when you’ll get paid.

What you’ll find in this collection aren’t just guides on how to join a pool — you’ll see real stories of what went wrong, who got ripped off, and which platforms actually deliver. From state-controlled mining in Venezuela to abandoned DeFi projects that promised pool rewards but vanished overnight, this isn’t theory. It’s what people actually experienced. You’ll learn how to spot fake pools, understand payout structures, and avoid the traps that turn mining dreams into losses. No fluff. Just what you need to mine smarter — or decide if it’s even worth it anymore.

9 October

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.