Solo Mining vs Pool Mining: Which Is Right for You in 2025?

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.

When you hear solo mining, the practice of using your own hardware to validate blockchain transactions and earn rewards without joining a group. Also known as individual mining, it’s the original way miners operated before pools became the norm. Back in 2010, a single person with a regular computer could mine Bitcoin and actually profit. Today? That’s like trying to win the lottery with one ticket while millions are playing.

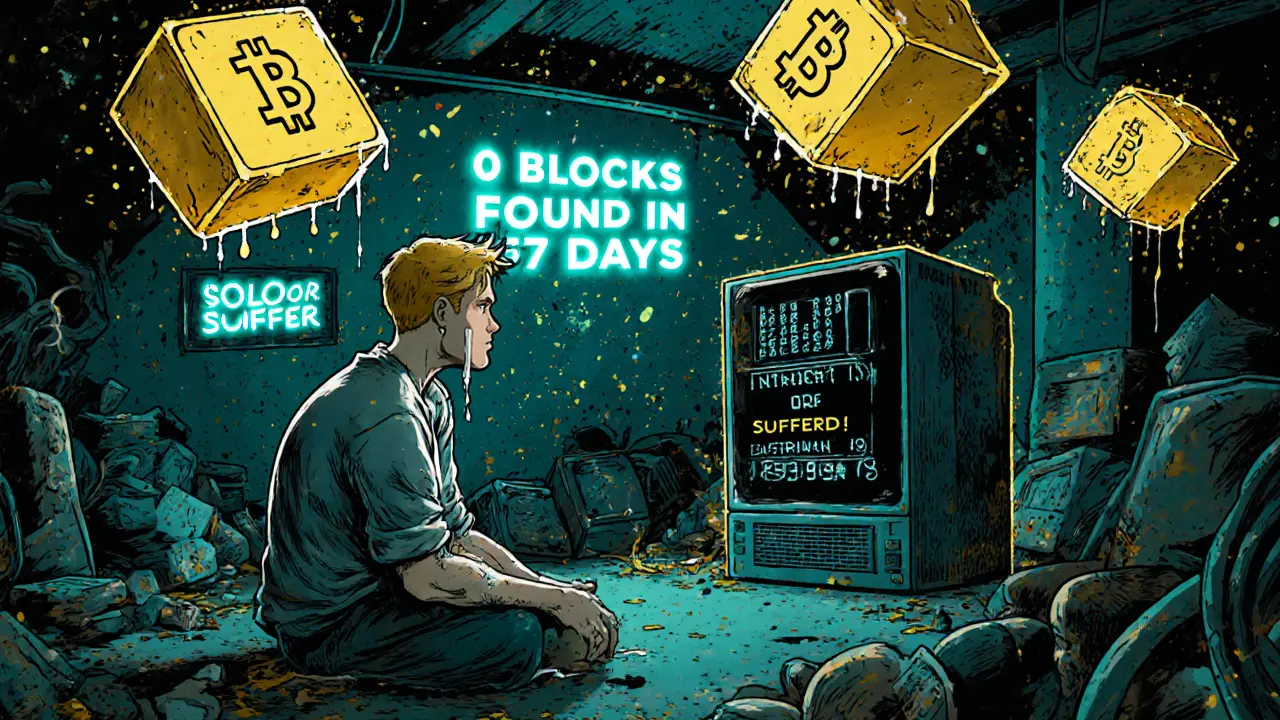

Bitcoin mining, the process of securing the Bitcoin network by solving complex math problems to add new blocks has become a high-stakes race dominated by massive farms with thousands of ASIC miners, specialized hardware built only for mining cryptocurrencies like Bitcoin. Also known as application-specific integrated circuit miners, these machines cost thousands and use more electricity than a small house. The network’s difficulty adjusts every two weeks to keep block times steady. That means if you’re not mining with the latest gear and cheap power, your chances of finding a block are near zero. Most solo miners go months—sometimes years—without a single reward. That’s why mining pool, a group of miners who combine their computing power to increase their odds of earning rewards, then split payouts proportionally exists. Pools don’t guarantee big wins, but they give you small, steady payments. Solo mining? You get nothing… until you get everything.

It’s not all dead, though. Some altcoins like Monero, Vertcoin, and even newer privacy-focused chains still allow solo mining with consumer-grade hardware. Why? Because they’re designed to resist ASIC dominance. If you’ve got an old GPU lying around and you’re not chasing Bitcoin, solo mining might still be worth a shot. But if you’re thinking about Bitcoin, you’re not just competing with other people—you’re competing with entire warehouses full of machines running 24/7.

There’s also the cost factor. Electricity isn’t just a line item—it’s your biggest expense. In places like Texas or Kazakhstan, cheap power makes mining profitable. In Europe or California? You’re paying more to run your miner than you’ll earn in a month. And don’t forget hardware wear. ASICs burn out fast under constant load. Replacing one can cost more than your monthly electricity bill.

So why do people still try solo mining? For the thrill. For the pride. For the dream of hitting that one block and walking away rich. It’s the last vestige of crypto’s early days—when you could mine with your laptop and feel like you were part of something real. Today, that feeling is rare, expensive, and risky. But if you’re willing to accept the odds, it’s still possible.

Below, you’ll find real stories and breakdowns from people who’ve tried it—some who walked away, others who kept going. You’ll see which coins still reward solo effort, what gear actually works, and how to spot scams pretending to offer "easy solo mining" solutions. This isn’t about getting rich quick. It’s about understanding whether you’re playing the game—or just paying to watch it.

9 October

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.