Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

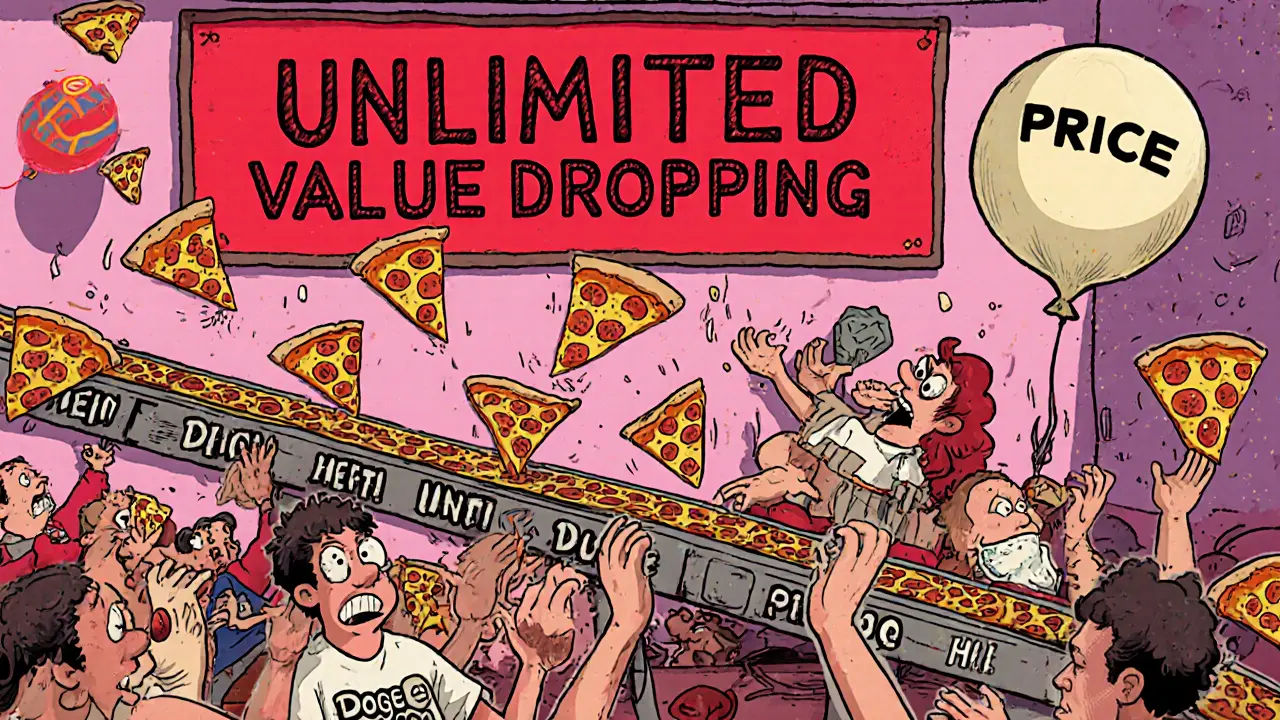

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

When a project token burn mechanism, a process where cryptocurrency tokens are permanently removed from circulation to reduce total supply. Also known as token destruction, it’s a way to make a coin scarcer — and potentially more valuable — over time. This isn’t just marketing. Real projects like Binance Coin (BNB), Ethereum (ETH), and Shiba Inu (SHIB) have burned billions of tokens to signal commitment and fight inflation.

Think of it like taking cash out of circulation. If there are fewer tokens available but demand stays the same or grows, price pressure often rises. But not all burns are equal. Some are scheduled — like BNB’s quarterly burns tied to trading volume. Others are one-time events, like when a team burns unsold tokens after a fundraising round. Then there are burns tied to transaction fees, where a portion of every trade gets destroyed automatically. That’s the kind of deflationary design that keeps holders interested.

The real value of a token burn mechanism, a method used to control token supply and influence market perception. Also known as supply reduction strategy, it works best when paired with actual usage. A coin with zero trading volume that burns tokens? That’s just smoke. But a DEX like Ref Finance, where users pay tiny fees and those fees get burned? That’s real utility. The same goes for platforms like KCCSwap or OpenSwap — if they’re dead, their burn claims mean nothing. You can’t burn your way to value if no one’s using the product.

Not every project that talks about burning tokens actually does it transparently. Some use fake burn reports or burn tokens they don’t own. That’s why you need to check blockchain explorers. Look for the actual wallet address that receives burned tokens — it should be a known, unspendable address like 0x000…dead. If the project can’t show you that, treat it like a scam. The best burns are public, verifiable, and tied to something real — like trading activity, staking rewards, or protocol fees.

And here’s the catch: a token burn doesn’t guarantee price growth. It’s just one tool. If the team disappears, the community leaves, or the tech breaks down, burning tokens won’t save it. That’s why projects like Flowmatic ($FM) and Project Quantum (QBIT) failed — they burned tokens while offering nothing else. The burn looked good on paper, but the project had no users, no liquidity, and no future.

What you’ll find in the posts below are real examples — the good, the bad, and the outright fake. Some projects used burns smartly. Others used them to trick people. You’ll see how Binance’s burn schedule actually moved markets, how meme coins like Pepes Dog (ZEUS) burned tokens but still collapsed, and why some airdrops like DSG and ACMD had burn claims that meant nothing because the tokens never traded. This isn’t theory. It’s what happened. And if you’re holding a token that says it burns, you need to know if it’s real — or just a headline.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.