Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

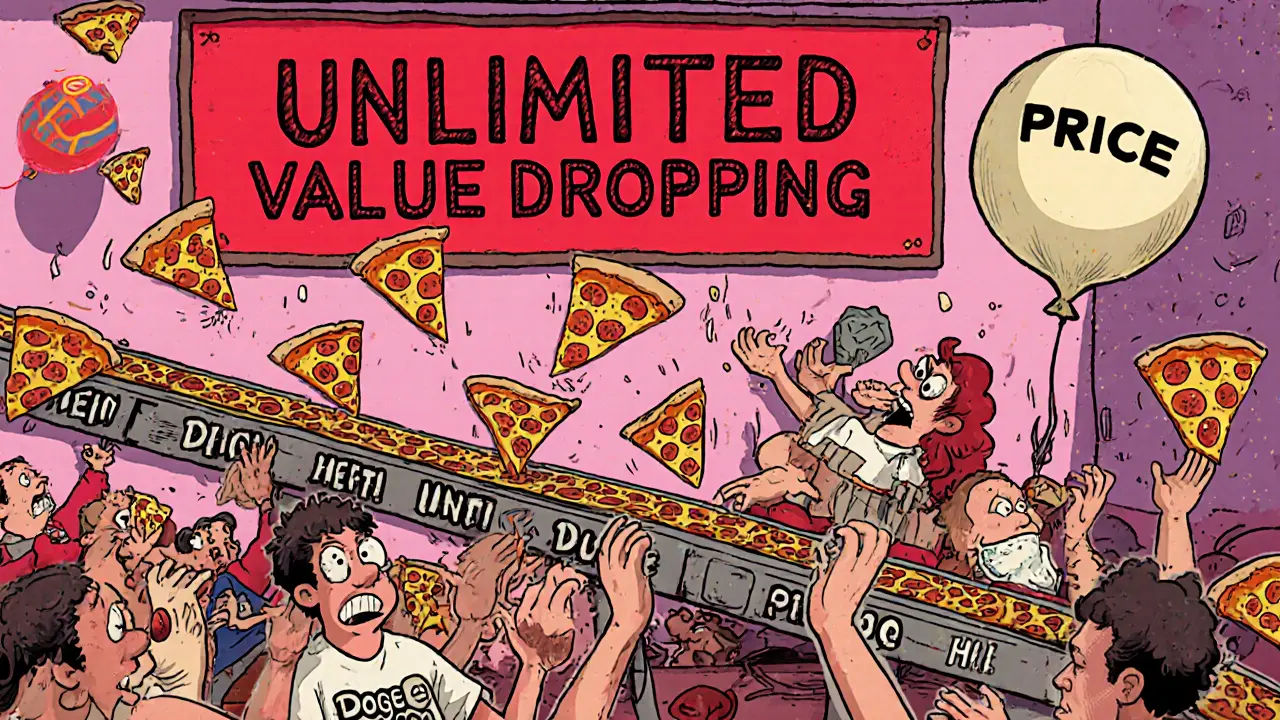

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

When you buy a new crypto token, you might think you own it right away—but that’s not always true. Token vesting schedules, a system that locks up crypto tokens over time to prevent early dumping and stabilize price. Also known as token lockups, they’re built into nearly every serious blockchain project to protect investors from sudden sell-offs. Think of it like a payroll for founders and early backers: instead of getting all their tokens on day one, they earn them slowly, over months or even years.

This isn’t just about fairness—it’s about survival. If a team got 10 million tokens and sold half the next day, the price would crash, everyone else would lose money, and the project would die. That’s why token unlock, the scheduled release of locked tokens to wallets or exchanges is carefully planned. Most projects stagger unlocks: 10% at launch, 10% every 6 months, the rest over 3 years. Some even tie unlocks to milestones, like hitting a certain number of users or launching a product. Crypto project tokens, the digital assets issued by blockchain startups to fund development and reward users only gain real value when the team stays aligned with the community’s long-term success.

But not all vesting schedules are created equal. Some projects hide bad terms in fine print—like giving insiders a 2-year cliff (meaning they get nothing for two years, then get 100% at once). Others lock up venture capitalists for 5 years but let early users claim tokens immediately. That imbalance creates tension. You’ll see it in projects like BinaryX’s token swap or the quiet collapse of Flowmatic ($FM), where token distribution fueled distrust instead of growth. Meanwhile, platforms like Ref Finance and Bunicorn use clear, fair vesting to build community trust.

What you’re about to see in the posts below isn’t just a list of articles—it’s a real-world look at how vesting schedules play out. Some projects used them right. Others used them to hide a slow exit. You’ll find breakdowns of token unlocks, how airdrops tied into vesting, and why some tokens vanished after their lockup ended. Whether you’re checking a new coin before investing or trying to understand why a project failed, knowing how tokens are released tells you more than any price chart ever could.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.