Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

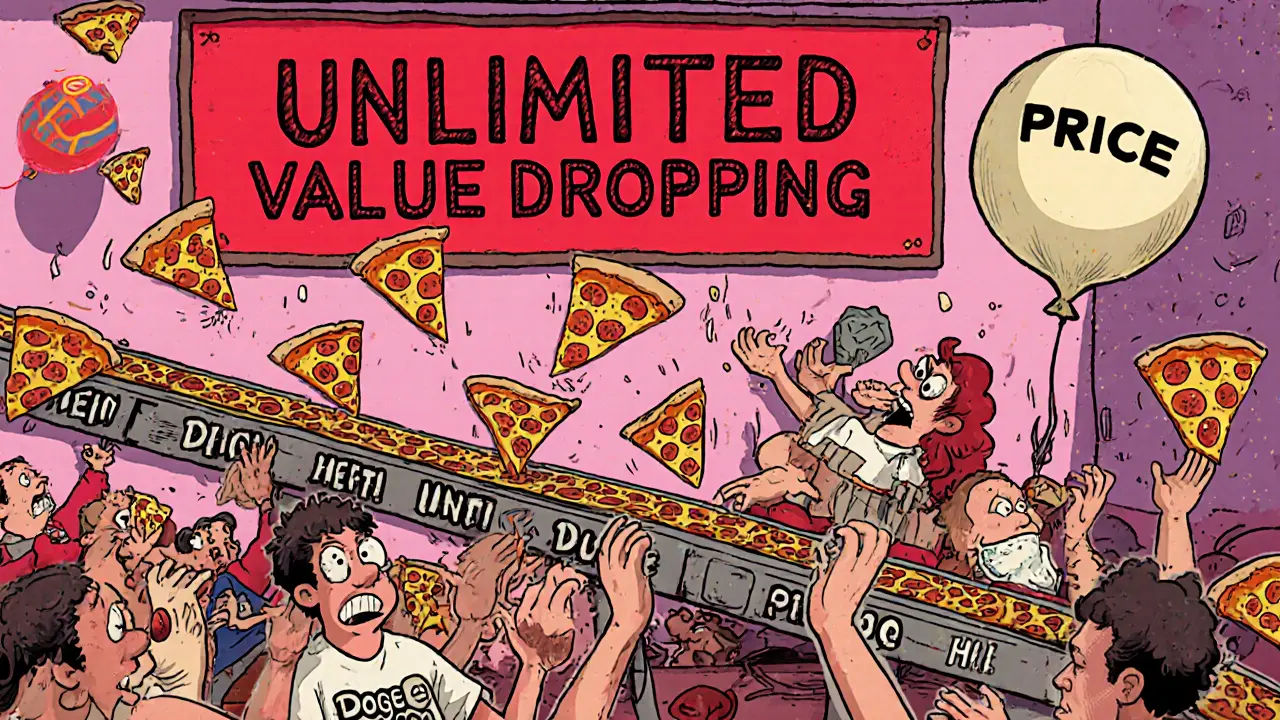

When a cryptocurrency has an unlimited token supply, a system where no maximum number of coins is fixed, and new tokens can be minted indefinitely. Also known as inflationary tokenomics, it’s the opposite of Bitcoin’s 21 million cap. This isn’t just a technical detail—it shapes whether a coin holds value over time or turns into a speculative gamble. Projects with unlimited supplies often argue they need flexibility to reward users, fund development, or adjust for burns. But in practice, it often means the token’s value gets diluted as more coins flood the market.

Look at Pepes Dog (ZEUS), a meme coin with a 420-trillion supply and no real utility. Each token is worth a fraction of a cent—not because it’s valuable, but because there are so many of them. The same logic applies to DSG token, a token with zero trading volume and no circulating supply. These aren’t failures because the tech is broken—they’re failures because the economic model ignores basic supply and demand. Compare that to Ref Finance (REF), a DeFi platform on NEAR with controlled token emissions and clear utility. Even though REF doesn’t have a hard cap, its emission schedule is transparent and tied to real usage. That’s the difference between a pump-and-dump and a sustainable system.

Unlimited supplies aren’t always bad—some chains use them to fund staking rewards or governance incentives. But if you’re holding a token with no supply limit, ask: Who controls the minting? Is there a burn mechanism? Are new coins being issued to insiders or the public? If the answer is vague, you’re likely holding something that could lose value faster than a meme coin after a hype wave dies. The posts below show you real cases—some where unlimited supply worked as a tool, others where it became a warning sign. You’ll see how projects like BinaryX, Flowmatic, and KCCSwap either managed supply carefully or let it spiral out of control. This isn’t theory. It’s what’s happening right now in the market.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.