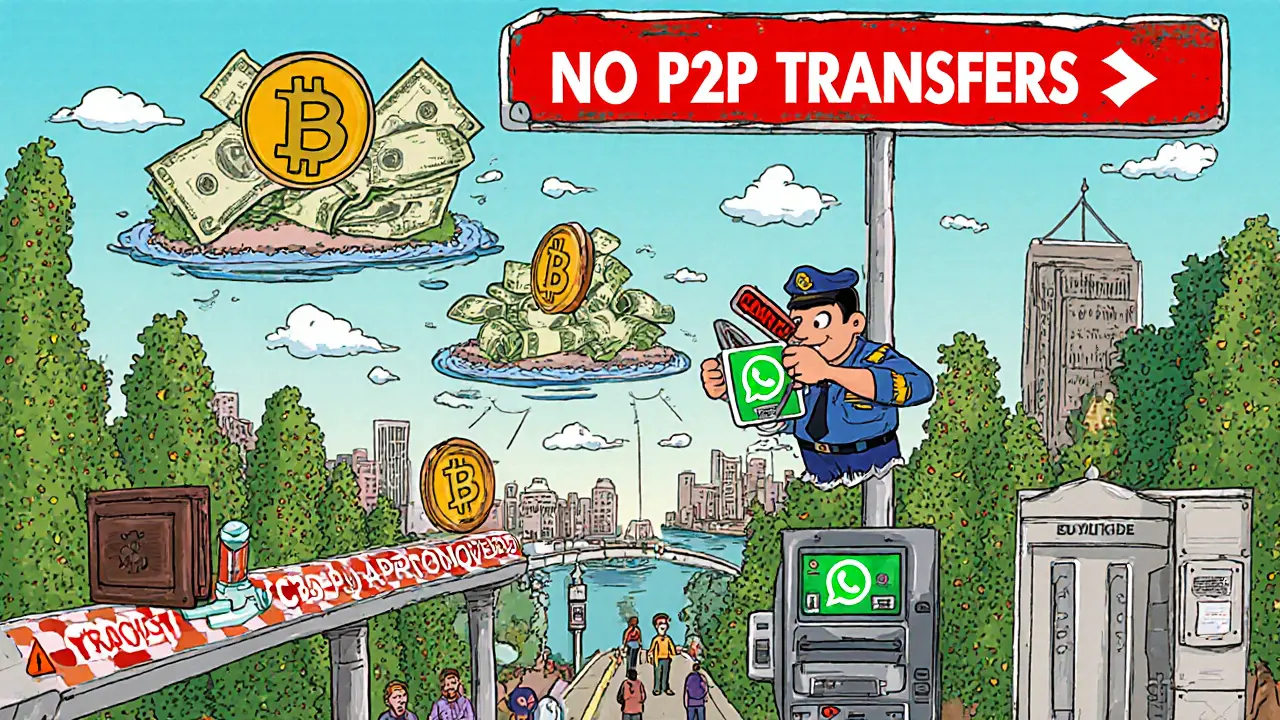

Just a few years ago, if you tried to buy Bitcoin through a bank in Jordan, you’d be breaking the law. Banks were ordered to cut off all ties with cryptocurrency exchanges. Wallets were ignored. Trading happened in secret-over WhatsApp, in basements, through peer-to-peer deals. But on September 14, 2025, everything changed.

From Ban to Blueprint: How Jordan Turned Its Crypto Policy Around

In 2014, the Central Bank of Jordan issued a warning: no banks, no ATMs, no transfers involving Bitcoin or any other cryptocurrency. The reason? Volatility. Fraud. Money laundering. At the time, it made sense. Crypto was wild, unregulated, and often linked to shady online markets. Jordan, like many countries, chose caution. But the ban didn’t stop people from trading. It just pushed it underground. Thousands of Jordanians kept buying and selling crypto anyway. Some used foreign exchanges. Others traded directly with friends. The government knew it was losing control. And by 2023, after successfully getting removed from the FATF grey list for anti-money laundering improvements, the message was clear: regulation, not prohibition, was the only way forward. Enter Law No. 14 of 2025-the Virtual Assets Transactions Regulation Law. This wasn’t a tweak. It was a complete overhaul. The old ban? Officially dead. In its place: a detailed, enforceable legal framework that brings crypto into the light.What Banks Can and Can’t Do Now

Under the new law, banks in Jordan aren’t just allowed to work with crypto-they’re being given a roadmap to do it safely. But there are strict limits. Banks can now exchange virtual assets for Jordanian Dinars and offer custodial services. That means you can open a bank account that holds your Ethereum or Solana, securely, under government oversight. You can convert your crypto to cash and back again, legally. But here’s the catch: banks cannot process transfers between crypto wallets. They can’t send Bitcoin from one user to another. They can’t act as crypto payment gateways. Why? Because the Central Bank wants to keep the Jordanian Dinar as the backbone of the financial system. They’re not trying to build a crypto economy-they’re trying to safely integrate digital assets into the existing one. This isn’t just about control. It’s about stability. If banks could move crypto freely, capital could flood out of the country overnight. This rule prevents that.Who’s in Charge Now?

The old days of one agency giving vague warnings are gone. Now, three key bodies share responsibility:- Central Bank of Jordan (CBJ) - Handles monetary policy, licensing of financial institutions, and anti-money laundering rules for crypto transactions.

- Jordan Securities Commission (JSC) - Oversees crypto as an investment asset. If you’re trading tokens like stocks, they regulate it.

- Anti-Money Laundering Unit - Monitors suspicious activity and enforces reporting rules.

Licensing Is Now Mandatory-And Penalties Are Severe

If you run a crypto exchange, wallet service, or trading platform in Jordan, you must get licensed. No exceptions. The requirements are strict: full Know Your Customer (KYC) checks, transaction logs, regular audits, and real-time reporting of suspicious activity. Think of it like running a bank-but for digital assets. Violate the rules? You’re looking at at least one year in prison, fines between 50,000 and 100,000 Jordanian Dinars (roughly $70,000-$140,000 USD), plus your equipment and premises can be seized. This isn’t a slap on the wrist. It’s a deterrent designed to wipe out the underground market. And yes-that includes people running crypto trading groups on Telegram or Instagram. If you’re facilitating trades without a license, you’re breaking the law now. The government isn’t going after casual buyers. But if you’re acting as a middleman, you’re fair game.What’s Still Not Covered?

The law is smart enough to know it doesn’t have all the answers yet. So it leaves three major categories out:- Digital securities - Tokens that represent shares in a company or real estate. These are too complex for this law and will be handled separately.

- Digital financial assets - Like tokenized bonds or loans. Also on hold.

- Central Bank Digital Currency (CBDC) - Jordan’s own digital dinar? Still in testing. Not part of this law.

How This Compares to the Region

Jordan isn’t the first in the Middle East to regulate crypto-but it’s one of the first to do it right. Countries like Kuwait, Egypt, and Iraq still ban it entirely. No licenses. No exceptions. Just silence. The UAE? They’ve gone all-in. Dubai has hundreds of licensed crypto firms. They even have a federal crypto regulator. But their system is more complex, with overlapping rules across free zones. Jordan’s approach is simpler, more centralized, and built on lessons learned from years of underground trading. It’s not flashy. But it’s stable. And that’s what matters for a country trying to rebuild trust in its financial system after years of regulatory gaps.Why This Matters for Regular People

If you’re just someone who bought Bitcoin in 2021 and held it through the ban, this law changes everything. You can now cash out legally. No more hiding your wallet address. No more fearing a bank freeze. Your crypto is no longer a liability-it’s an asset, recognized by the state. For entrepreneurs, it’s even bigger. Startups building blockchain tools, payment apps, or crypto-based remittance services can now operate without fear. Investors from Europe and Asia are already watching. Jordan could become the gateway for compliant crypto in the Middle East. The FinTech Regulatory Sandbox, running since 2018, helped test real-world applications before the law passed. That’s rare. Most countries draft laws in boardrooms. Jordan tested them in labs.What’s Next?

The next few years will be about implementation. Banks need to train staff. Exchanges need to build compliance systems. The public needs to understand what’s legal and what’s not. There are still gray areas. For example, if you trade crypto with a friend and don’t report it, are you breaking the law? The law doesn’t say. That’s something regulators will need to clarify. But the direction is clear: Jordan is no longer trying to stop crypto. It’s trying to own it. This isn’t just about money. It’s about modernization. About catching up. About proving that a small country can lead in digital finance-not by ignoring the future, but by shaping it.Is it legal to buy Bitcoin in Jordan now?

Yes. Individuals can legally buy, hold, and sell cryptocurrencies in Jordan under Law No. 14 of 2025. You can use licensed exchanges or bank-approved services to convert crypto to Jordanian Dinars. However, you cannot use banks to send crypto directly to other wallets or individuals.

Can I use my Jordanian bank account to trade crypto?

You can use your bank account to deposit or withdraw Jordanian Dinars when buying or selling crypto through a licensed Virtual Asset Service Provider (VASP). But your bank cannot directly facilitate crypto transfers or hold your digital assets unless they have CBJ approval for custodial services.

Are crypto transactions taxed in Jordan?

As of now, there is no specific crypto tax law in Jordan. However, profits from crypto trading may be subject to income tax under existing tax codes. The government has not yet issued official guidance, but taxpayers should keep records of all transactions in case regulations change.

What happens if I run a crypto exchange without a license?

Operating an unlicensed crypto exchange is a criminal offense under Law No. 14 of 2025. Penalties include at least one year in prison, fines between 50,000 and 100,000 Jordanian Dinars, closure of your business, and confiscation of equipment. This applies to anyone facilitating trades, even informally through social media.

Is Jordan’s crypto law similar to the UAE’s?

No. The UAE has a more complex, multi-layered system with federal and free-zone regulators. Jordan’s law is centralized, simpler, and focused on integrating crypto into the existing banking system rather than creating a parallel financial ecosystem. Jordan prioritizes stability and control; the UAE prioritizes scale and innovation.

Will Jordan launch its own digital currency?

Jordan is testing a Central Bank Digital Currency (CBDC), but it’s not part of Law No. 14 of 2025. The government is still evaluating the technical and economic impacts. A digital dinar could launch in the next few years, but it will be a separate project from the current crypto regulations.