Solo Mining vs Pool Mining: Which Is Right for You in 2025?

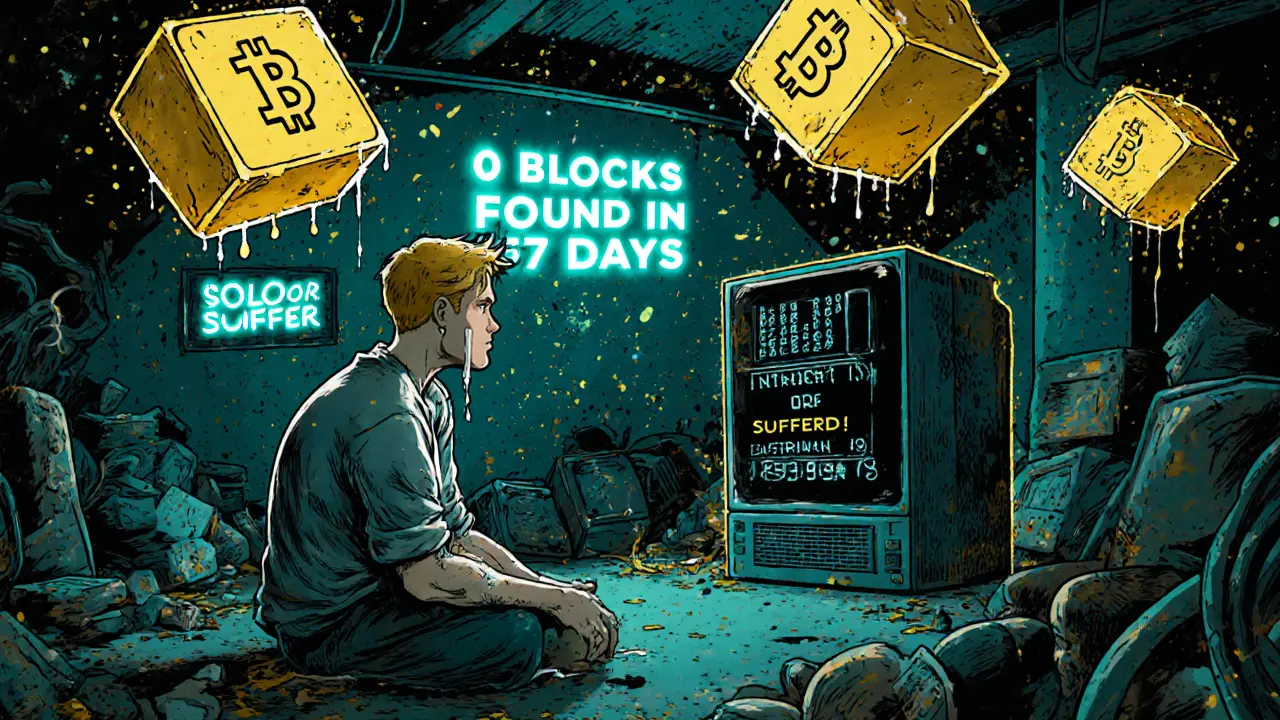

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.

When you hear Bitcoin mining, the process of validating Bitcoin transactions and securing the network using powerful computers. Also known as crypto mining, it’s what keeps Bitcoin running without banks or middlemen. It’s not digital alchemy — it’s math, electricity, and hardware working together to solve puzzles no one else can solve faster. Every ten minutes, a new block gets added to the blockchain, and the miner who solves it first gets rewarded in Bitcoin. That’s how new coins enter circulation — and why miners are the unsung backbone of the whole system.

But ASIC miners, specialized hardware built only for Bitcoin mining have changed everything. Gone are the days of mining with a gaming PC. Today, you need machines that cost thousands, use as much power as a small house, and run nonstop. That’s why mining isn’t done by hobbyists anymore — it’s dominated by big operations in places like Texas, Kazakhstan, and even Venezuela, where electricity is cheap or state-controlled. In Venezuela, for example, miners must join a government-run pool and risk having their gear seized if they don’t follow the rules. Meanwhile, in places like the U.S. and Canada, miners are racing to tap into renewable energy to stay profitable. The Bitcoin network, the decentralized ledger that records every Bitcoin transaction only stays secure if thousands of these machines are running around the clock. If mining gets too expensive or too regulated, the whole system could slow down — or worse, become centralized in the hands of a few.

And that’s where things get messy. Countries are starting to take sides. Some, like the U.S. and Germany, treat mining as a legitimate business. Others, like China, banned it outright. Nigeria and Vietnam are still figuring it out, with rules changing every few months. Even the UK’s HM Treasury is tightening oversight on crypto-related energy use. If you’re thinking about getting into mining, you’re not just buying hardware — you’re signing up for a legal, financial, and technical gamble. You need to know your local laws, your electricity costs, and whether your ROI even makes sense after two years. Most people don’t. That’s why so many end up stuck with silent machines and high bills.

What you’ll find below isn’t a list of mining rigs or profit calculators. It’s a collection of real stories — from failed ventures and government crackdowns to exchanges that got tangled up in mining scams. You’ll see how Venezuela’s state-run mining pool works, why Koinex shut down after India’s banking ban, and how fake platforms like CreekEx and Woof Finance tried to ride the mining hype. These aren’t theoretical guides. They’re lessons from people who got burned, confused, or misled. If you’re trying to understand Bitcoin mining beyond the hype, this is where the real picture starts.

9 October

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.