BridgeCoin BCO: What It Is, Why It Matters, and What You Need to Know

When you hear BridgeCoin BCO, a token built to connect different blockchains. Also known as BCO, it’s one of many attempts to solve the problem of isolated blockchains. But here’s the truth: most people don’t need it. If you’re trading on Ethereum or Solana, you’re probably already using a bridge — just not one called BCO.

Blockchains like Bitcoin, Ethereum, and BSC were never meant to talk to each other. That’s where cross-chain bridges, systems that move assets between different ledgers come in. Projects like Wormhole, Polygon Bridge, and LayerZero handle billions in daily transfers. BridgeCoin BCO is one of hundreds of small tokens trying to do the same thing — but without the traffic, liquidity, or team backing. Most of these tokens vanish within a year. The ones that stick? They’re not called BCO.

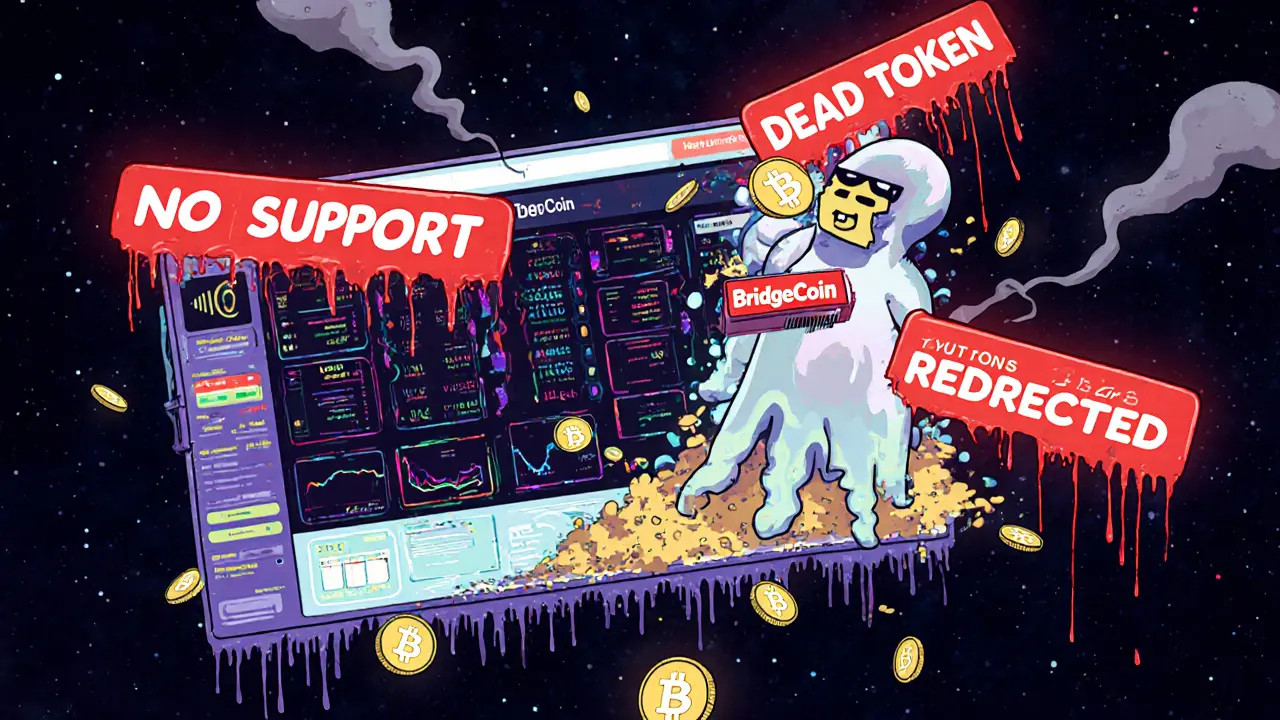

What you’ll find in the posts below aren’t success stories. They’re warnings. You’ll see how crypto exchanges, platforms where people buy, sell, and trade digital assets list tokens like BCO without due diligence. You’ll read about airdrops, free token distributions meant to build community tied to projects with zero trading volume. And you’ll learn how DeFi platforms, decentralized systems that replace banks with code often become ghost towns after the initial hype dies. BridgeCoin BCO isn’t a revolution. It’s a footnote in a long list of forgotten tokens.

Don’t get fooled by the name. A bridge token doesn’t mean it’s safe. It doesn’t mean it’s useful. It just means someone thought it sounded like a good idea. The real bridges — the ones moving real money — don’t need flashy names. They just work. What’s below isn’t a guide to investing in BCO. It’s a map of where people lose money chasing tokens that don’t exist anymore. If you’re looking for a bridge that actually moves value, you won’t find it here. But you’ll learn exactly where to look instead.