Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

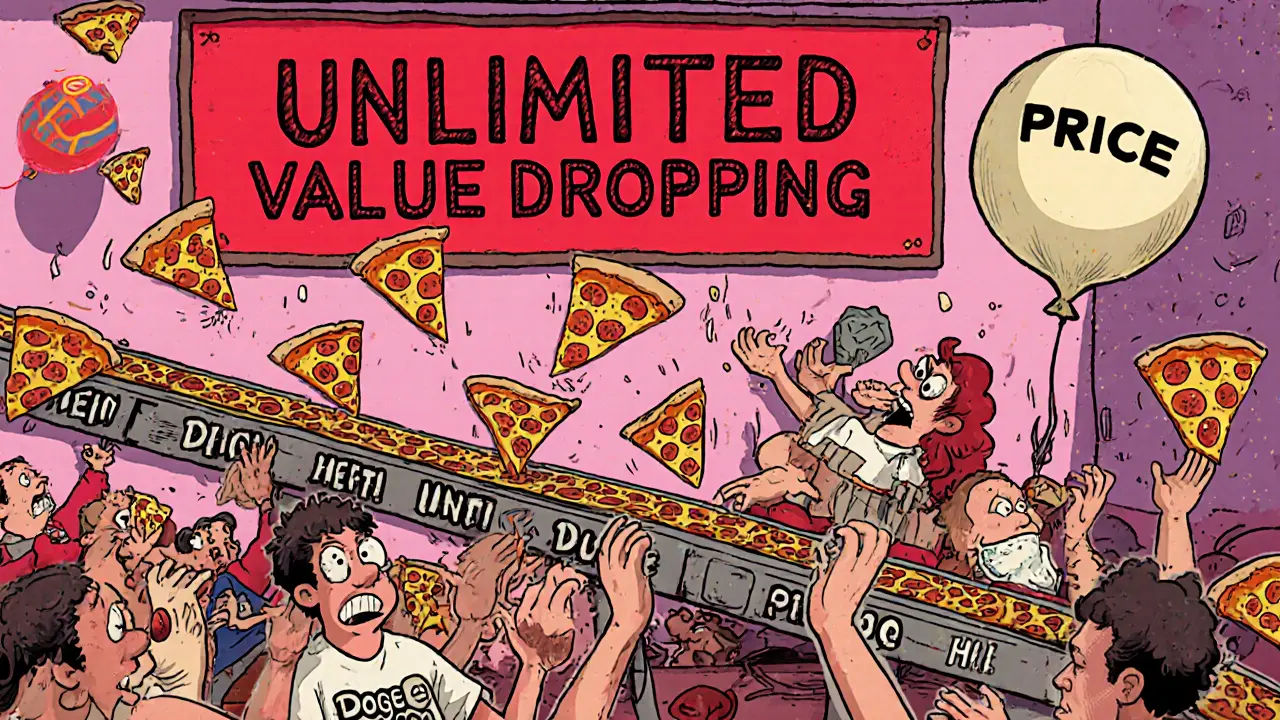

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

When you invest in crypto investment risks, the potential for sudden losses from scams, abandoned projects, or regulatory crackdowns. Also known as digital asset risks, these dangers aren’t theoretical—they’re happening every day to people who skip due diligence. You think you’re buying the next Bitcoin. Instead, you might be buying a token with zero liquidity, no team, and a website that disappeared last week.

Many of these risks come from places you wouldn’t expect. Take crypto scams, fake platforms like CreekEx or Woof Finance that look real but are designed to steal your funds. Or volatile crypto assets, tokens like Pepes Dog (ZEUS) or TajCoin (TAJ) with trillions of supply and no real use. These aren’t investments—they’re gambling chips with no table. Even "legit" projects like Flowmatic ($FM) or Project Quantum (QBIT) can vanish overnight because they never delivered anything beyond a whitepaper. And if you’re chasing airdrops like DSG or ACMD, remember: no trading volume means your tokens are worth less than the gas fee to claim them.

Regulation adds another layer of chaos. In Nigeria, crypto is legal—but only if you find a licensed exchange that actually exists. In Vietnam, you can trade only in local currency, but no exchange is officially approved yet. Meanwhile, in the UK, the FCA now watches stablecoin issuers closely, and in Venezuela, miners must join a state pool or risk losing their hardware. These aren’t policy updates—they’re survival rules. If you don’t track them, you’re not investing. You’re just guessing.

The real danger isn’t price drops. It’s thinking you’re safe because you used a "big name" exchange or joined a Telegram group full of hype. The posts below show you exactly what went wrong for others: fake exchanges, token swaps that erased holdings, airdrops that led to nothing, and DeFi platforms that collapsed from lack of users. You’ll see how people lost money—not because the market crashed, but because they trusted the wrong thing. This isn’t a warning. It’s a checklist. Read the stories. Avoid the traps.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.