DYORSwap: What It Is, Why It Matters, and What You Should Know

When you hear DYORSwap, a decentralized exchange built for fast, low-cost token swaps on emerging blockchains. It's one of many DEX platforms trying to carve out space between giants like Uniswap and PancakeSwap. But unlike those, DYORSwap doesn’t have a big marketing budget, a celebrity endorser, or a listing on CoinMarketCap. It’s quiet. And that’s often a red flag.

Most DeFi exchanges, platforms that let users trade crypto directly from their wallets without a middleman rely on liquidity pools and automated pricing. DYORSwap claims to do the same—but with lower fees and faster settlement. The problem? There’s almost no public data on its trading volume, user base, or smart contract audits. You won’t find it on crypto exchanges, centralized platforms where users deposit funds to buy and sell digital assets like Binance or Kraken. It lives only on its own site, often linked from obscure Telegram groups or Reddit threads.

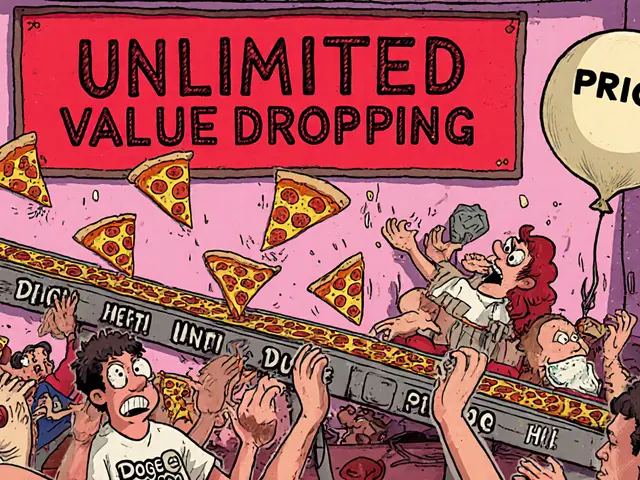

What you’ll find in the posts below isn’t hype. It’s truth. One post breaks down how DYORSwap’s tokenomics look suspiciously similar to abandoned projects like Flowmatic and XGT. Another shows how users lost funds after a "liquidity update" that turned out to be a rug pull. There’s also a guide on how to check if a DEX is real—using on-chain tools, not just a whitepaper. You’ll see how DYORSwap fits into the bigger pattern of low-liquidity DEXs that vanish after collecting initial deposits. And you’ll learn what to look for before you click "Connect Wallet" on any unfamiliar swap platform.

This isn’t about banning new tools. It’s about protecting your money. Thousands of users get burned every year because they assume "decentralized" means safe. It doesn’t. DYORSwap might be legitimate. But without transparency, community, or proof of use, it’s a gamble with your crypto. The posts here don’t guess. They show you the data. And if you’re thinking of using DYORSwap, you need to see it before you send a single token.