EmiSwap Polygon: What It Is, How It Works, and Where to Find Real Info

When people talk about EmiSwap Polygon, a decentralized exchange built on the Polygon network for low-cost token swaps. Also known as EmiSwap on Polygon, it’s often listed as a fast, cheap alternative to Uniswap — but there’s little public proof it actually exists. Most search results point to dead links, fake websites, or scam pages asking for wallet connections. Real DeFi platforms don’t hide their code, team, or liquidity. If you can’t find a verified contract on Polygonscan, or there’s no active community on Discord or Telegram, it’s probably not real.

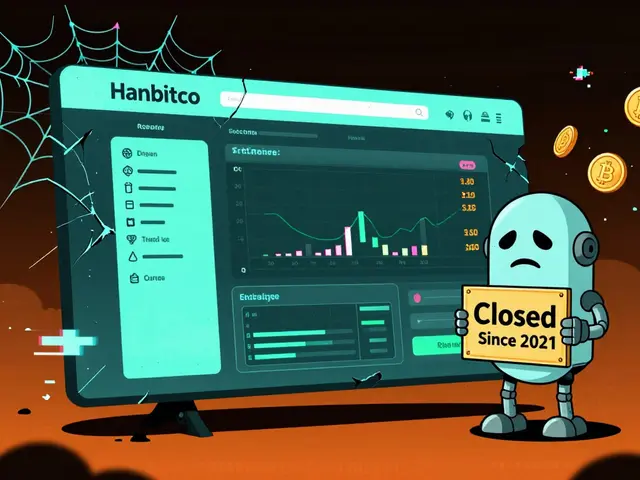

EmiSwap Polygon is often confused with legitimate Polygon-based DEXs like QuickSwap, a top decentralized exchange on Polygon with millions in daily volume and open-source code, or SushiSwap, a well-known cross-chain DEX with strong liquidity and transparent governance. These platforms have public audits, active developers, and real trading history. EmiSwap Polygon has none of that. It’s likely a copycat name used by phishing sites trying to steal funds from people searching for cheap swaps on Polygon.

Many users end up here after seeing fake airdrop alerts or YouTube ads promising free tokens from "EmiSwap". Those are scams. Real DeFi projects don’t give away tokens through random pop-ups. If you’re looking to trade on Polygon, stick to platforms with clear documentation, verified contracts, and community trust. The real value isn’t in chasing names that sound like DeFi — it’s in using tools that actually work.

Below, you’ll find real reviews of crypto exchanges and DeFi platforms on Polygon — some legitimate, some outright scams. You’ll learn how to spot fake DEXs, what to check before connecting your wallet, and where to find actual low-fee swaps. No fluff. Just facts.