RITA Meme Coin: What It Is, Why It Matters, and What You Need to Know

When you hear RITA, a meme-based cryptocurrency with no official team, whitepaper, or real-world use. Also known as RITA token, it’s one of hundreds of coins built on hype, not hardware or code. Unlike Bitcoin or Ethereum, RITA doesn’t solve a problem. It doesn’t run a network. It doesn’t even have a working website. It’s just a token on a blockchain, with a funny name and a Twitter account full of memes. That’s it. And yet, people buy it. Why? Because they think someone else will buy it later—for more money. That’s the entire business model of most meme coins.

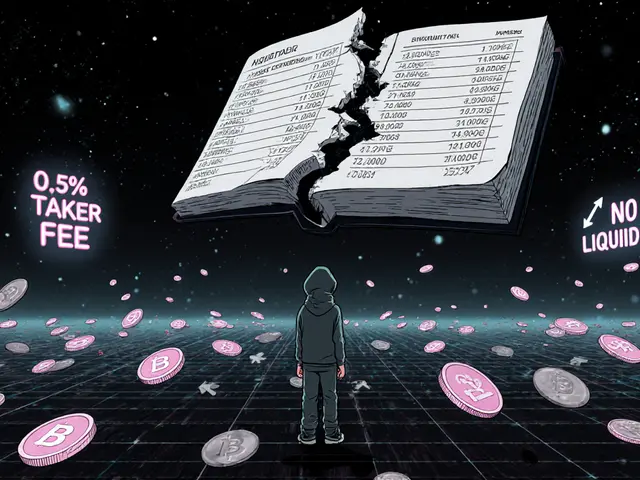

RITA fits right in with other meme coins, cryptocurrencies created for fun or viral attention, often tied to internet culture. Also known as dog coins or community tokens, they rely entirely on social media buzz, not technical innovation. Think Dogecoin, Shiba Inu, or Pepes Dog (ZEUS)—all of which started as jokes and became trading cards for speculators. RITA is no different. It has a 420-trillion supply, a price per token so low it’s practically invisible, and zero liquidity on major exchanges. There’s no team behind it. No roadmap. No audits. No updates. Just a chart that spikes when a Reddit thread goes viral and crashes when the hype dies.

What makes RITA dangerous isn’t that it’s fake—it’s that it looks real. The token shows up on CoinGecko, has a contract address, and even has a Discord server. But none of that means anything. You can’t trade it on Binance. You can’t use it to pay for anything. You can’t stake it. You can’t earn yield from it. The only thing you can do is buy it and hope someone else buys it from you. That’s not investing. That’s gambling with crypto-shaped chips.

And here’s the truth most meme coin buyers ignore: 98% of these tokens die within six months. They vanish. Their websites go dark. Their social accounts get deleted. Their wallets get emptied by the original creators. The people who bought in early? They’re left holding digital trash. RITA isn’t an exception—it’s the rule. It’s part of a larger pattern you’ll see across dozens of posts here: tokens with no utility, no transparency, and no future.

If you’re looking at RITA because you saw a YouTube video promising 100x returns, you’re not alone. But you’re also not the first person to fall for it. The same thing happened with Flowmatic ($FM), Project Quantum (QBIT), and TajCoin (TAJ). All had shiny websites. All had influencers pushing them. All collapsed without a trace. The only difference? RITA is still alive—barely. And that’s what keeps people coming back. The hope. The luck. The fantasy that this time, it’ll be different.

Below, you’ll find real reviews of other tokens that looked like RITA—and then disappeared. You’ll see how scams are built, how airdrops turn into traps, and why even "legit" exchanges can list worthless coins. You won’t find fluff. You won’t find hype. Just facts. And if you’re still thinking about buying RITA, maybe you should ask yourself: who’s really making money here? Hint: it’s not you.