Cryptocurrency Trading: How to Trade Smart in 2025

When you trade cryptocurrency trading, the act of buying and selling digital assets like Bitcoin, Ethereum, or niche tokens on exchanges or decentralized platforms. Also known as crypto trading, it’s not just about price charts—it’s about knowing which platforms are real, which are scams, and where the rules even apply. Most people think it’s all about timing the market, but the real game is avoiding traps. You could have the best strategy, but if you’re using a fake exchange like CreekEx or Woof Finance, you’re just giving your money away.

That’s why crypto exchange, a platform where users buy, sell, or trade cryptocurrencies, often with fiat currency support. Also known as digital asset exchange, it’s the backbone of everything you do matters more than ever. In 2025, some exchanges like COREDAX are built for specific countries—Korea, for example—where local banks and regulations lock you in. Others, like OpenSwap on Harmony, are dead. And then there are fake ones like Armoney or CreekEx, made to look real so they can steal your keys. You don’t need 10 exchanges—you need one that’s licensed, has real volume, and doesn’t vanish overnight.

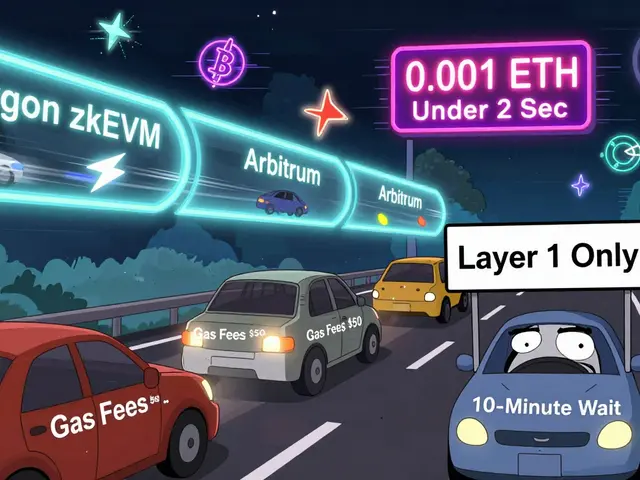

Then there’s DeFi platform, a decentralized system that lets you swap, lend, or earn crypto without a middleman, usually on blockchains like NEAR or Ethereum. Also known as decentralized exchange, it’s where tools like Ref Finance or SushiSwap live. But not all DeFi is equal. Some, like Ref Finance, have real users and fees under a penny. Others, like SushiSwap on Arbitrum Nova, have almost no liquidity—meaning you can’t even trade your tokens when you want to. And then there are tokens like Flowmatic ($FM) or TajCoin (TAJ) that look like investments but have zero team, zero code, and zero future. Trading crypto isn’t just about picking winners—it’s about not picking losers disguised as winners.

And you can’t ignore the rules. Countries like Nigeria, Vietnam, and Indonesia changed their crypto laws in 2025, but enforcement is messy. Some let you trade, others ban stablecoins. The UK now requires exchanges to follow the FCA. Bangladeshis use VPNs just to access Binance. If you’re trading, you’re also navigating legal gray zones. A tax move in Portugal might be illegal in the U.S. A token airdrop in Indonesia might be worthless if the project vanishes—like ACMD or DSG. You’re not just trading crypto. You’re trading trust, legality, and survival.

Below you’ll find real reviews, busted scams, and clear breakdowns of what’s working—and what’s not—in 2025. No fluff. No hype. Just what you need to know before you click buy.