State Bank of Vietnam and Crypto Regulations in Southeast Asia

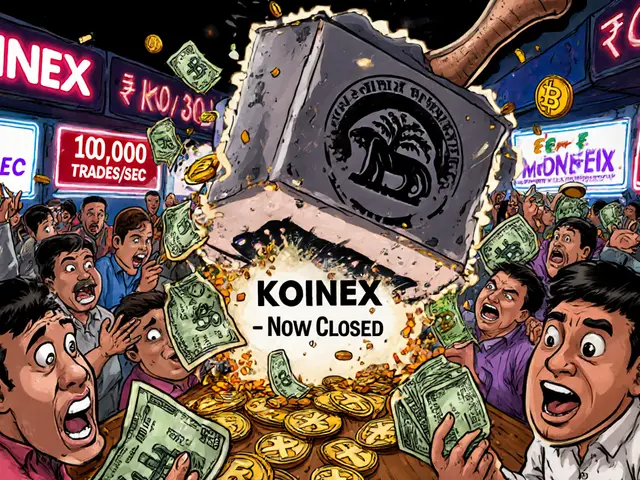

State Bank of Vietnam, the central monetary authority responsible for Vietnam’s currency, financial stability, and payment systems. Also known as Ngân hàng Nhà nước Việt Nam, it has consistently blocked cryptocurrency from being used as legal tender since 2017 and maintains tight control over all digital asset activities within the country. Unlike countries like Indonesia or Thailand, where crypto trading is permitted under oversight, Vietnam’s approach is outright restrictive—no exchanges can operate legally, no banks can process crypto deposits, and no businesses can accept Bitcoin or Ethereum as payment. This hasn’t stopped people from trading, though. It’s forced users underground, into peer-to-peer networks, and into using VPNs to access foreign platforms like Binance or Kraken.

Behind the ban, the State Bank of Vietnam worries about capital flight, money laundering, and loss of monetary control. Their fear isn’t theoretical—Vietnam has one of the highest rates of crypto adoption in Southeast Asia, with millions of users trading daily despite the risks. The central bank crypto policy is also shaped by regional pressure. Neighboring countries like Singapore and Malaysia have embraced regulated crypto markets, but Vietnam chose isolation. This creates a weird gap: you can’t legally buy crypto with a Vietnamese bank account, but you can still trade it using local peer-to-peer platforms like Paxful or LocalBitcoins, often with cash or mobile payments.

The Vietnam cryptocurrency policy isn’t just about control—it’s about timing. While the government explores its own digital currency, the e-VND, it’s making sure private crypto doesn’t steal the spotlight. That’s why you’ll find articles here about how Vietnamese traders bypass restrictions, how scams target them through fake exchanges, and why local projects like KCCSwap or Bunicorn airdrops are often inaccessible without offshore tools. The digital currency Vietnam project is still in testing, but until it launches, the real action is happening in the shadows—on Telegram groups, in P2P trades, and through wallets that never touch a Vietnamese bank.

What you’ll find below aren’t just random posts—they’re real stories from people living under these rules. From how Bangladeshis use VPNs to access exchanges, to why Nigerian traders face similar chaos, to how Korean and UK users navigate their own strict regimes, this collection shows that crypto regulation isn’t just policy—it’s a daily battle. And in Vietnam, that battle is being fought without legal armor.